A partner invoice is a billing statement summarizing what you owe a partner each month. All partner payments invoices must be settled timeously to keep your account in good standing. impact.com generates your invoices on the 1st of each month unless you choose to configure custom payout scheduling in your template terms. For guidance on the best funding strategy for your program, see our Guide to Funding Strategies for Brands.

Note: Although invoices are generated once a month, impact.com creates multiple invoices if the transactions involved have different payment due dates. For this reason, you may see more than one invoice for a single partner in a given month.

The Partner Payments Invoices screen offers two document types, downloadable in PDF format:

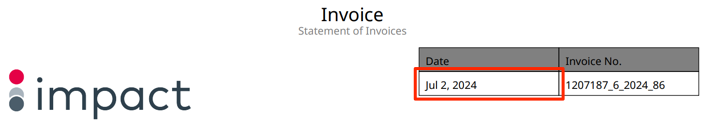

A Statement of Invoices (SOI) document summarizes all invoices generated for your partner.

A Partner Invoice document contains an individual invoice for your partner.

Learn more about partner payments invoices.

From the top navigation bar, select your balance → Documents.

From the left navigation menu, under Documents, select Partner Payments Invoices.

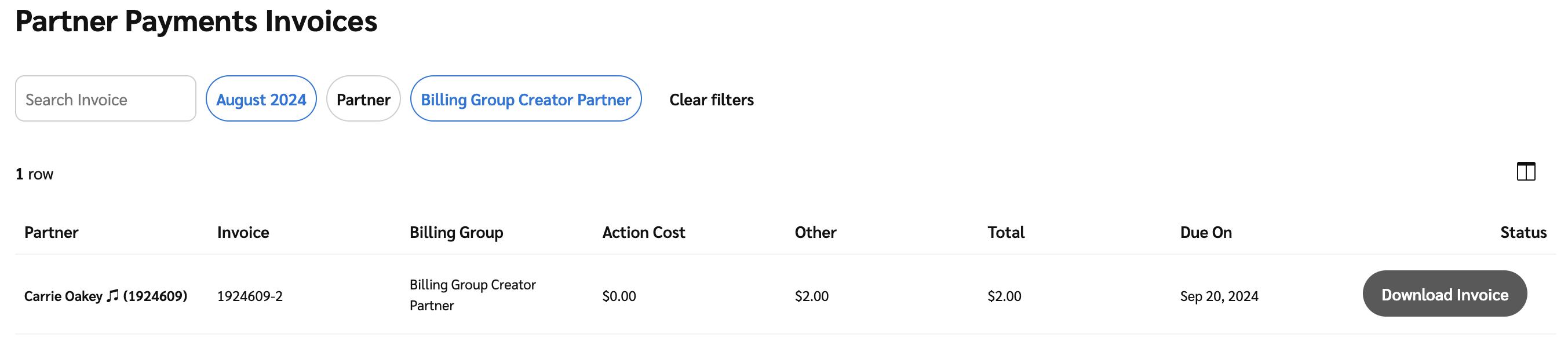

Below Partner Payments Invoice Summary, you can filter for the data you want to view.

See the Filter reference and Table reference for more information.

Filter

Description

Month

Filter by month and year the SOI represents.

Billing Group

Filter by the billing group to which the SOI belongs.

This filter will only show up if you have multiple billing groups enabled.

Table Column

Description

Month

Indicates which month and year the SOI represents.

Billing Group

Indicates the billing group with which the SOI is associated.

Invoices

Lists how many partner payments invoices were generated for the month. Select the number to view the list of individual partner payments invoices.

Generated on

Indicates the date on which the SOI document was created.

Total Due

Shows the aggregated amount of funds owed to partners.

Status

Shows the current status of the SOI. The status can be:

Paid

Not Yet Due

Past Due

From the top navigation bar, select your balance → Documents.

From the left navigation menu, under Documents, select Partner Payments Invoices.

On the Partner Invoice Summary screen, under the Invoices column, select the Number.

On the Partner Payments Invoices screen, hover over the invoice you want to download and select Download Invoice.

When checking an invoice for its due date, one of 3 options can appear in the date field:

Invoice Due Date Option | Description |

|---|---|

(The actual due date) | This is the date by which the invoice must be settled if your contract terms with your partner align with your funding strategy. |

"Various" | Refer to the action details to see when you must pay your partner for driving the actions aggregated on this invoice. |

"Due upon receipt" | This means that invoices are considered due when generated and first appear in your account. |

Depending on your funding strategy, you will most likely need to fund your account before an invoice is even generated, as you may only have a short time to settle your partner payments invoices before they become overdue. Use the Upcoming Partner Payments report to view what will likely be included in your invoices.

If you are subject to Value Added Tax (VAT), at least one of the following VAT codes is likely to appear on your partner payments invoices. If you are a European-based brand, see when VAT is charged.

VAT Code | Description |

|---|---|

T0 | The transaction was zero-rated. No VAT payment is due. |

T1 | The transaction has a standard rate. The standard VAT levy is applied to the transaction. |

T4 | You provided goods or services in the European Union (EU). VAT's reverse charge mechanism will shift the obligation of paying the tax onto you. |

T9 | VAT does not apply to the transaction, and does not need to appear on your VAT return. |