W-9 Compliance is an optional feature in Advocate that helps your brand and your participants remain compliant with US tax law. It tracks which participants have submitted a W-9 form and ensures that rewards exceeding $599.99 USD in a calendar year are properly handled.

To read more about W-9 Advocate compliance visit W-9 Compliance Explained for Advocate.

This article explains how to view, update, and bulk-manage W-9 tax compliance statuses for your participants.

Follow this process to check whether a W-9 form was marked as collected for a specific participant.

From the left navigation menu, go to

[Engage] → Participants.

Search for and select the name of the participant.

On the participant’s profile, select the Payouts and Tax tab.

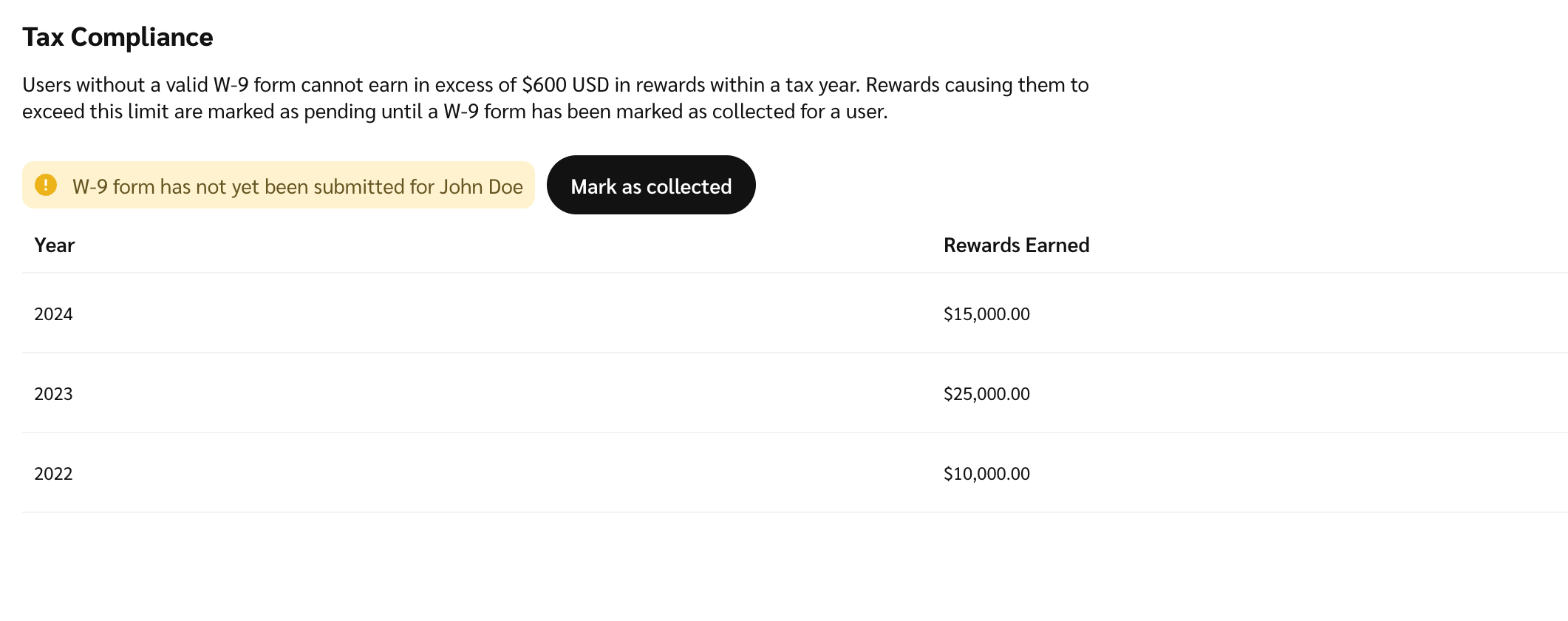

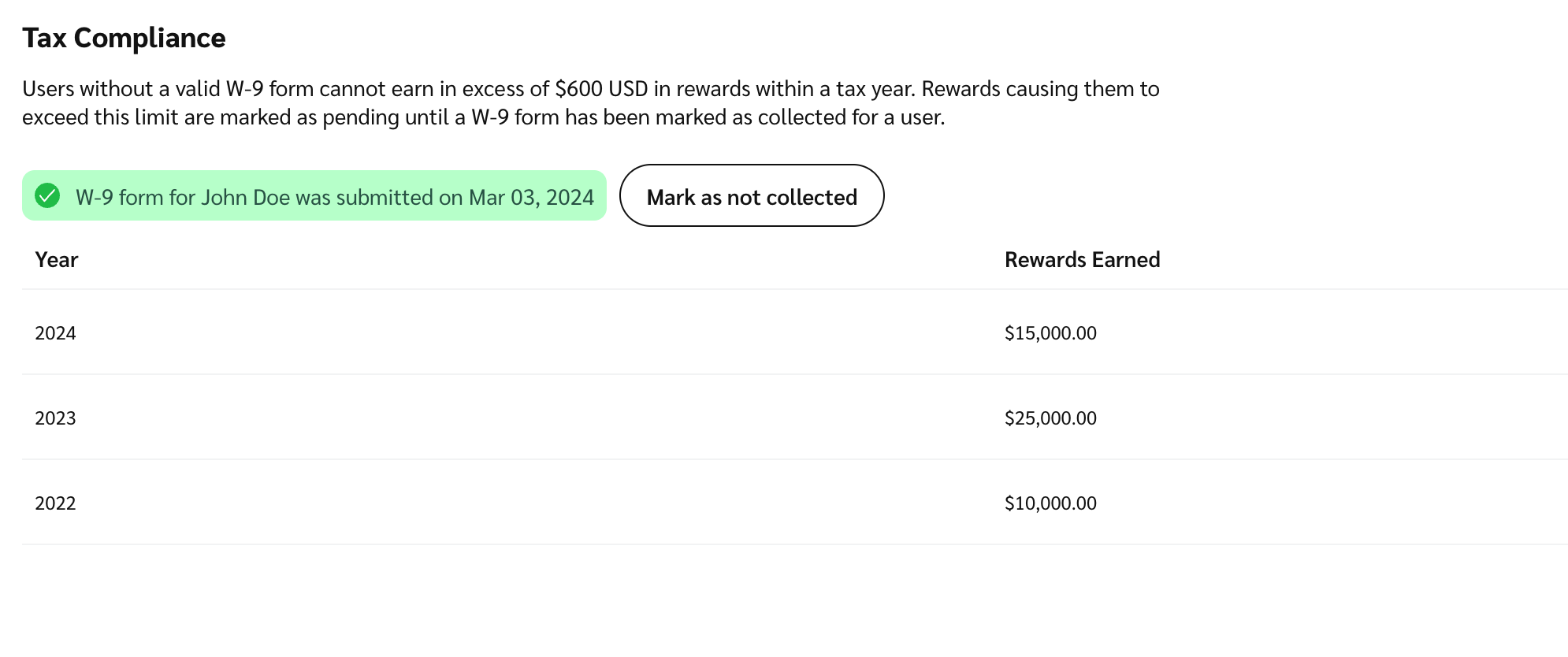

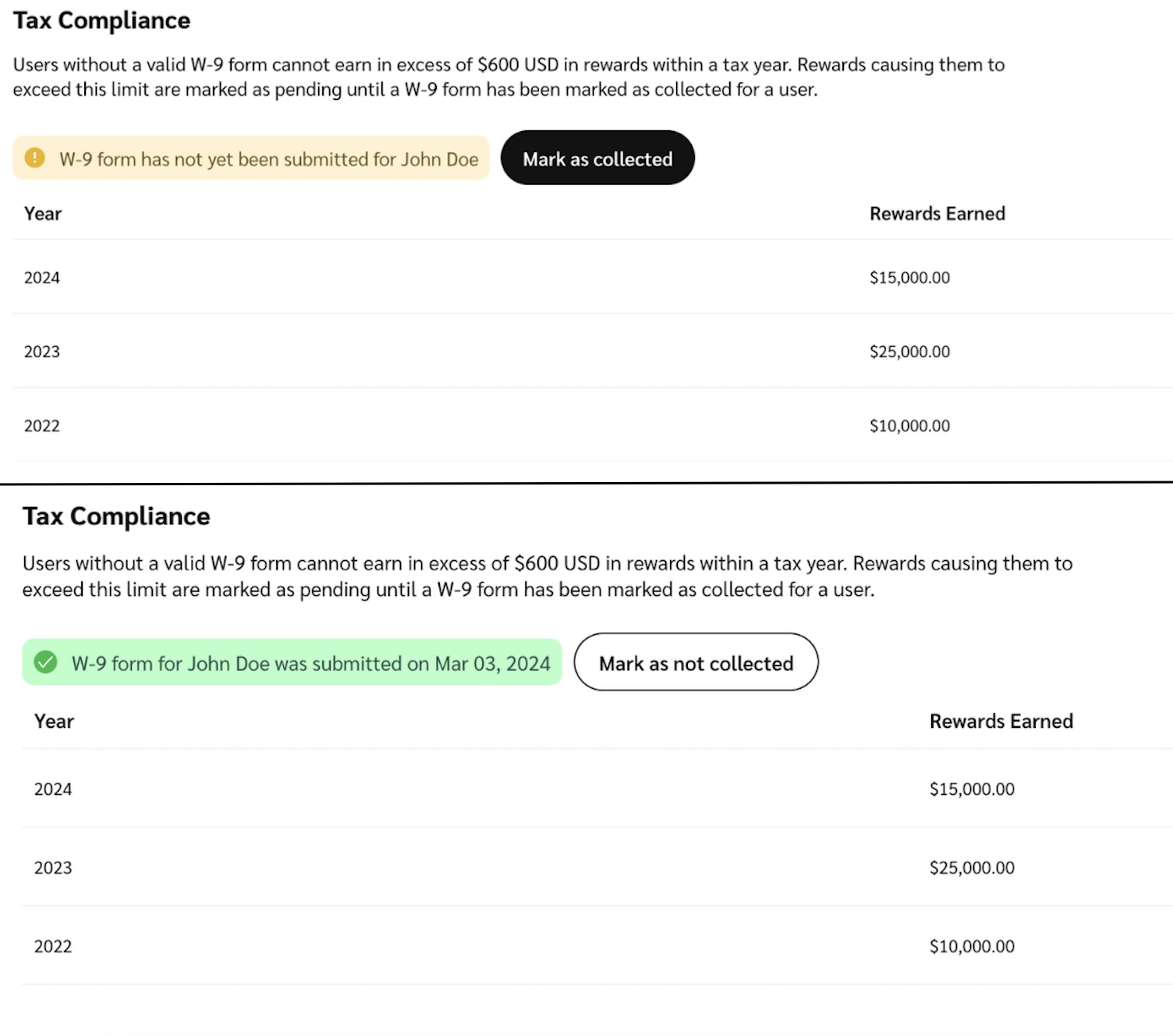

Within this tab, you’ll see:

The participant’s W-9 form status (Collected / Not Collected).

A breakdown of rewards earned per calendar year.

Update an individual participant's W-9 status

Bulk update W-9 statuses

You can use a bulk user import to mark W-9 forms as Collected for multiple participants at once. This action:

Exempts participants from the $599.99 USD annual reward limit for current and future tax years.

Automatically releases any rewards that were placed in a pending state due to a missing W-9.

Download the .csv sample file or use the following .csv data to create a sample file:

accountId,id,firstName,lastName,email,referable,referralCode,paymentProviderId,locale,referredBy.code,referredBy.isConverted,imageUrl,customFields.province,customFields.postal 5ac26c53ead2245a935343d2,5ac26c53ead2245a935343d3,Sara,Reyes,j9lqxclgm4qdu84cphyh@example.com,,B0DK58Z3HEF03NJ14TVB,,ar_QA,6PKBDHB79W434XG788MM,false,,QC,P1X 4N3 5ac26c53ead2245a935343d4,5ac26c53ead2245a935343d5,Dominic,Blake,sxh96ct7caztbbqjsdyb@example.com,,E1THJUBSHVGANSC9OCEM,,,4AXZAV7FSA9S4FZKTCGT,true,,MB,S9C 4S9 5ac26c53ead2245a935343d6,5ac26c53ead2245a935343d7,Dora,Dunn,u5071o1fw6d0uhj12r8f@example.com,,NE8ZZSJNECOLFQ76TWBX,,,7NSJJWLWNYA3SS8YPEGZ,false,,AB,B4R 4V8 5ac26c53ead2245a935343d8,5ac26c53ead2245a935343d9,Francis,Walters,4i8jalsp0q5n8z2bui6g@example.com,,KEHV3PG3P6CWQ4VBT03Y,,th,3LBNN1M0UGNN6EGONUFW,false,,SK,J0X 4A8

For each participant whose W-9 you’ve collected:

Add a column labeled:

dateUSTaxFormSubitted.Enter the Unix timestamp (epoch time) representing the date the W-9 was received.

Use an online converter to generate this from a standard date (e.g.,

epochconverter.com).

Save the file.

Follow the bulk import instructions to upload your file.