Set Up Cash Payouts for Advocate

Your widget or microsite can be set up to collect participants’ tax and banking details. After their information is on file, they are eligible to receive cash rewards (in alignment with your program goals). For more information about the feature and what's required from your brand and your participants, refer to Cash Payouts for Advocate Explained.

Step 1: Enable cash payouts

This feature is only accessible to specific impact.com editions or add-ons. Contact us to upgrade your account and get access!

If your account is eligible for cash payouts, you can enable the option from your account settings.

From the top navigation bar, select

[User profile] → Settings.

On the left, below Advocate Settings, select General.

In the Tax Compliance section, select Enable Payouts & Tax Compliance.

If you're already using the W-9 Tax Compliance feature, you won't be able to turn on Cash Payouts and Tax Compliance within impact.com. Reach out to support for help.

Confirm that you want to Enable this feature.

Continue with setting up the feature. You can either:

Select Fund Account or Edit Content in the confirmation modal to be taken directly to the relevant pages.

Close the confirmation modal and follow the steps in the setup checklist.

Step 2: Configure your reward units

Select which cash reward units you want to allow participants to be paid out for. If you don’t already have a cash reward unit, you’ll need to set one up.

From the left navigation menu, select [Engage] → Rewards → Reward Units.

At the top-right of the page, select Create Reward Unit.

For the Reward Unit Type, select Cash.

Enter a descriptive Reward Unit Name.

Optionally, enter a Reward Unit ID.

[Toggle on] Currency.

Note: You must select this option even if you only want to issue the payout in one currency.

From the dropdown list, select the impact.com-supported currency or currencies in which you want to pay out the reward unit.

Select

[Checked box] Use impact.com to send a payment to your participants.

Select Create Reward Unit.

From the left navigation menu, select [Engage] → Rewards → Reward Units.

Hover your cursor over a cash reward unit and select Edit.

[Toggle on] Currency.

Note: You must select this option even if you only want to issue the payout in one currency.

From the dropdown list, select the impact.com-supported currency or currencies in which you want to pay out the reward unit.

Select

[Checked box] Use impact.com to send a payment to your participants.

Select Update Reward Unit to finalize your changes.

You can now create a program reward based on this reward unit, and configure your program goals to specify when participants should earn that reward. We recommend applying a pending period to the goal's action to discourage self-referral attempts.

Step 3: Fund your account

You must have enough funds in your impact.com account to accommodate the cash payouts. If you don’t, your participants will not receive their earned rewards. Learn how to deposit funds into your impact.com account.

Step 4: Configure your widget or microsite

Cash payouts can be set up in either your verified access widget or your microsite.

Widget

You can either add the Tax and Cash components to your widget or apply the Cash Payouts Referral Widget template.

Important: Applying a template to an existing widget will remove all of your customizations, so we recommend using the template only on a new widget.

From the left navigation menu, select [Engage] → Content.

On the Widgets card, select Edit Widgets.

Select a program widget to edit.

From here, you can either add the Tax and Cash components or apply the Cash Payouts Referral Widget template.

Learn how to add components or apply templates with the widget editor. For a description of the available Tax and Cash components, refer to Widget & Microsite Components Explained.

Optionally, customize the content and presentation of the components.

Select Save draft at the top-right corner of the page.

Changes you've saved won't be shown to your participants until you publish the program draft.

Microsite

New microsite

If you don’t have a microsite yet, then you can use the auto setup option to create a pre-configured Cash Payouts Microsite.

Step 1: Set up the microsite

From the left navigation menu, select

[Engage] → Content.

On the Microsite card, select Setup.

A new setup screen will open.

On the Auto setup card, select Setup Referral Microsite.

Select the Cash Payouts Microsite option, then select Auto Setup.

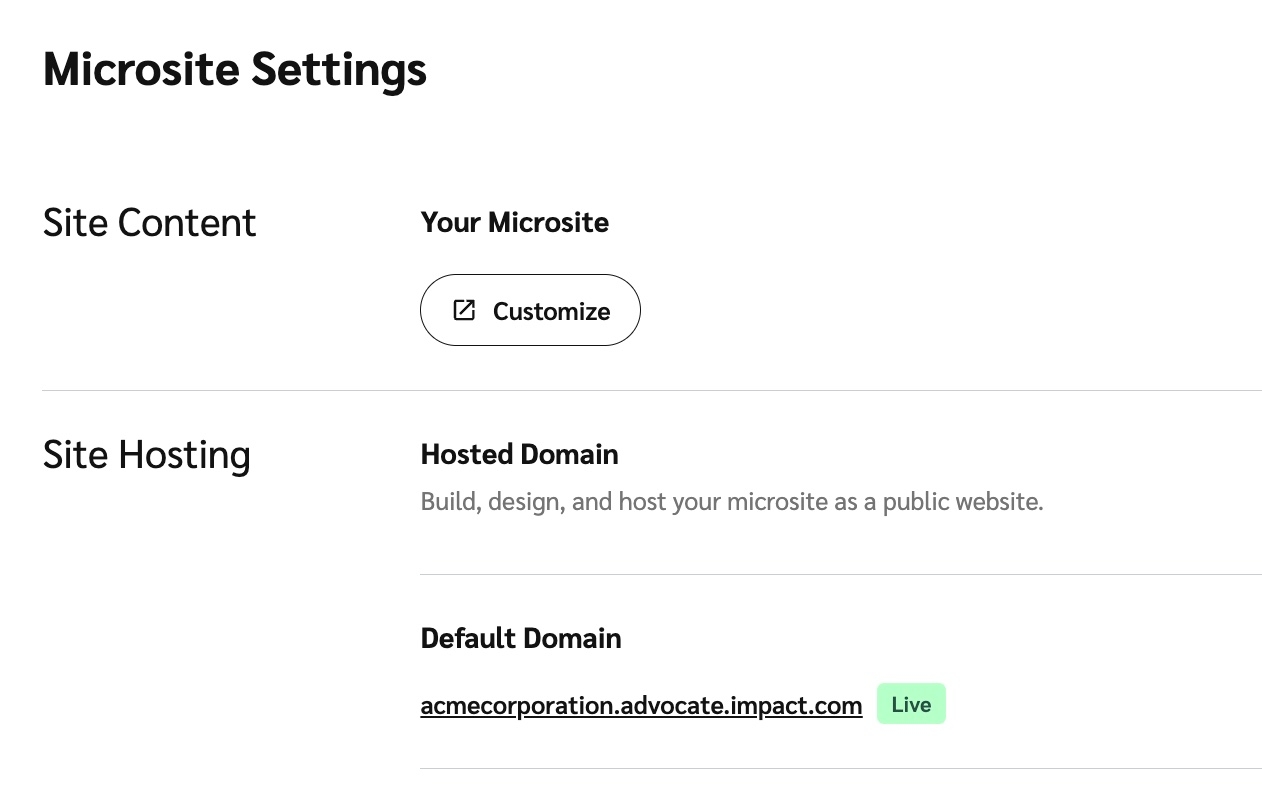

In the Site Content section, select Customize to further make changes to your microsite.

229CC8D4-1DD9-4A17-9586-287AC98B1F6C.jpeg Your new microsite has a Tax and Cash page within the Logged In Layout, which your participants can use to provide their tax details and banking information.

Learn more about the microsite editor and how to customize your microsite's layouts and pages.

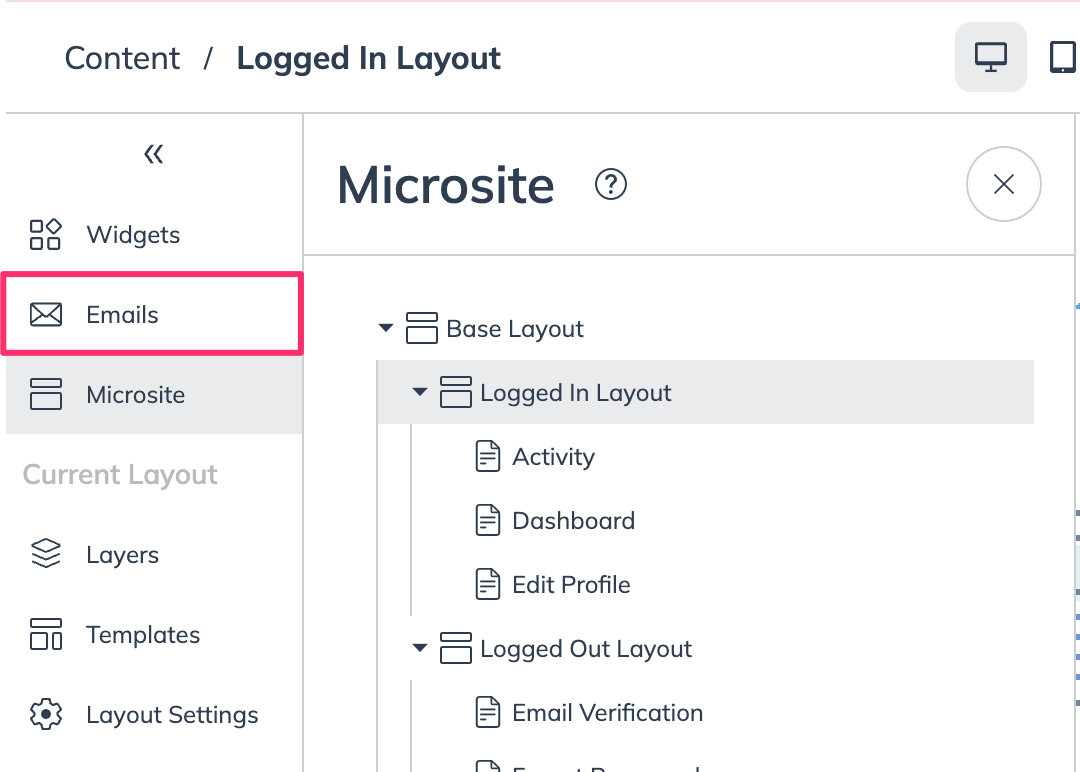

48FADFB9-5D30-4E41-BEE4-5EA3D10094E7.jpeg

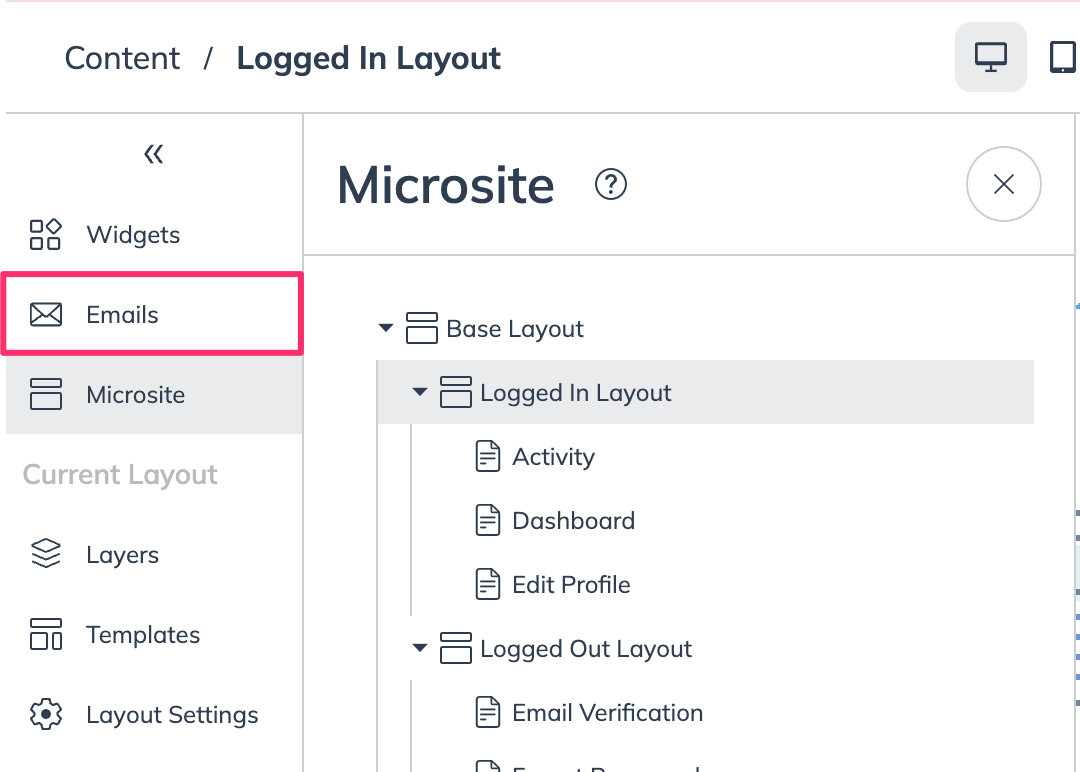

Step 2: Optionally, customize the payout reminder email

If a participant has earned a cash reward but hasn't provided us with their tax or banking details, impact.com sends them a reminder to provide this information so they can get their reward. You can modify the email to match your branding.

In the Content menu, select Emails to change to the email editor.

Program_Analytics.png Select tax-payout-reminder-email.

Customize the sender information, subject line, or content as desired.

Learn more about editing your Advocate program emails.

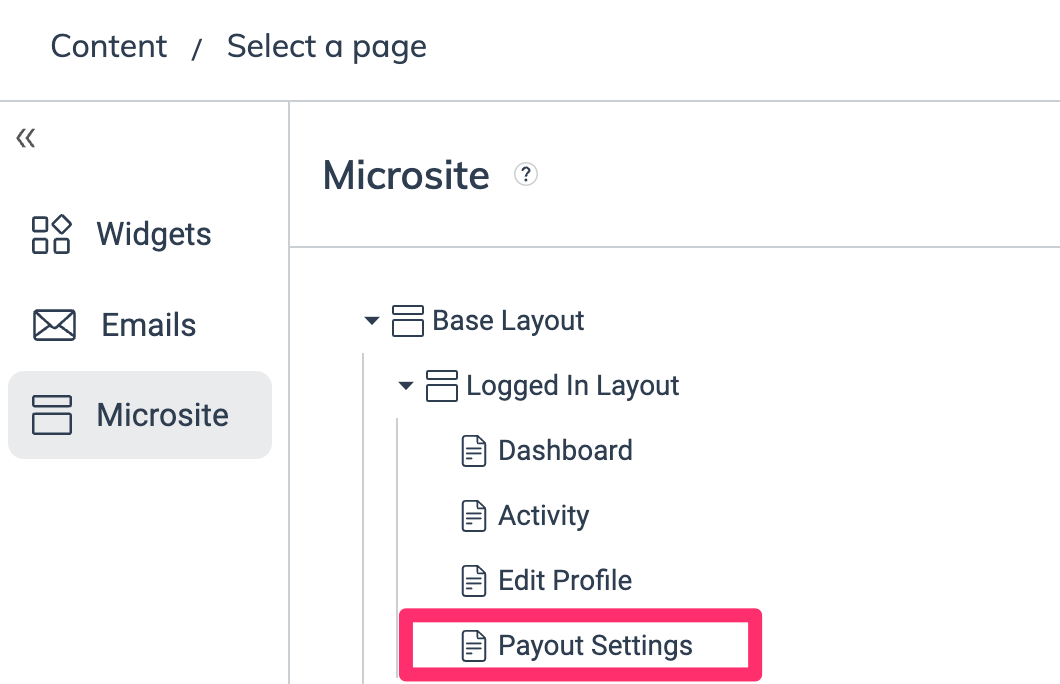

Existing microsite

If you have an existing microsite, then you’ll need to add a Tax and Cash page to the Logged In Layout.

Step 1: Add a new page

From the left navigation menu, select

[Engage] → Content.

On the Microsite card, select Edit content.

On the left, in the Microsite menu, select + Add Page.

From the Inherited Layout dropdown list, select Logged In Layout.

Enter a Page Title, e.g.,

Payout Settings.Enter the URL for your page. You’ll reference this URL when adding the page to your microsite’s sidebar navigation menu.

Add a forward slash (

/) before the name you want to use and use hyphens in the case of a multi-word URL, e.g.,/payout-settings.For more instructions about adding a page to the sidebar navigation menu, refer to Customize Microsite Layouts and Pages.

From the Allowed users dropdown list, select Verified.

From the Redirect for disallowed users dropdown list, select the page where you want unauthorized users to be sent, e.g., your Login or Register page.

Select Add.

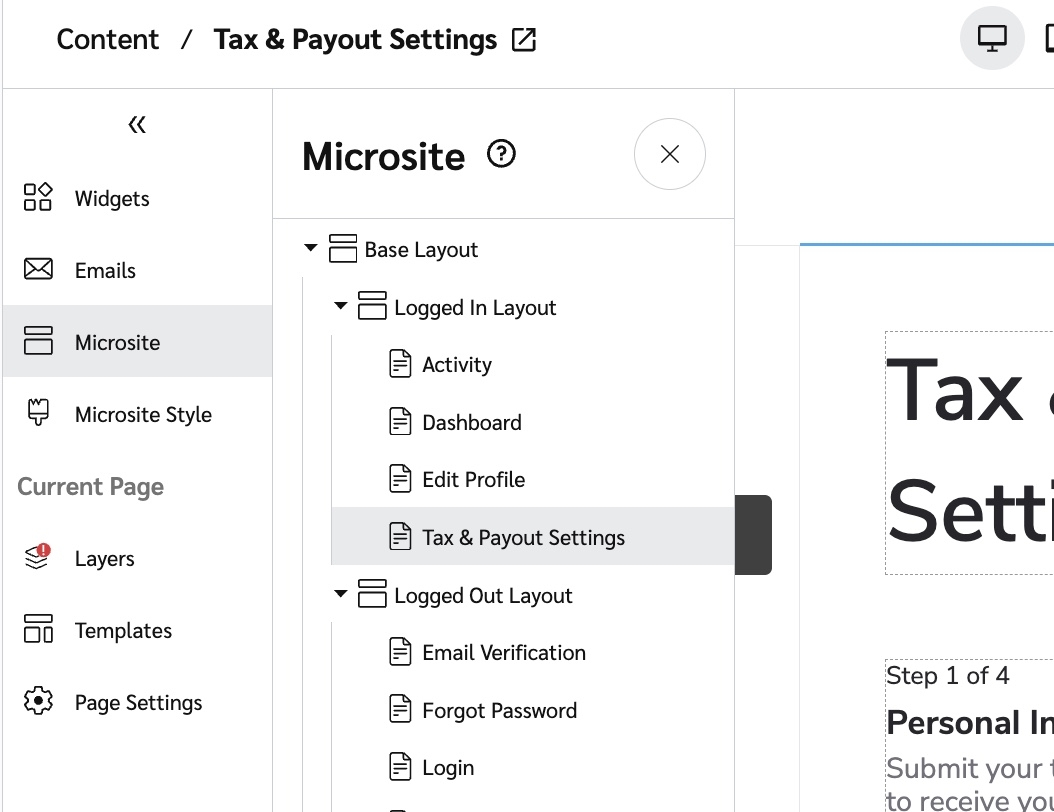

Your new page will now appear below Logged In Layout in the Microsite menu.

Step 2: Apply the Tax and Cash Payouts template

In the Microsite menu, select the new page you created in Step 1. It will load in the background.

In the Microsite menu, from the Current Page section, select Templates.

Find the Tax and Cash Payout Template card and select Apply Template → Apply Template.

At the top-right of the page, select Save.

Step 3: Optionally, customize the payout reminder email

If a participant has earned a cash reward but hasn't provided us with their tax or banking details, impact.com sends them a reminder to provide this information so they can get their reward. You can modify the email to match your branding.

In the Content menu, select Emails to change to the email editor.

Program_Analytics.png Select tax-payout-reminder-email.

Customize the sender information, subject line, or content as desired.

Learn more about editing your Advocate program emails.

Last updated

Was this helpful?